Uncategorized

Retirement in Canada: Tips, Accounts, and Plans

If you make saving money a key component of your financial strategy, you can still retire comfortably in Canada.

The main obstacle for many individuals is that retirement is such a vague idea, surrounded by so many unresolved issues, that it may be difficult to prioritize it above other, more urgent matters.

You may be able to achieve your life goals and have enough money to survive into your elderly years with the correct retirement planning technique.

The factors that go into effective financial planning for retirement include your living expenditures, the date you want to retire, and the amount of money you’ll need to save to meet your post-retirement objectives.

Planning for retirement entails considering various aspects and circumstances, which we shall discuss presently.

Retiring in Canada: Some Tips

Sort Out Your Estate

Your retirement is when you should start sorting out your finances and estate. Getting prepared for after you pass is a part of this, and that means planning things out for it. If you’re planning on moving to Canada as you retire, it could be worth sorting out your estate beforehand.

Whether you’re working with a California estate lawyer or one in Toronto, the process is much the same. It’s more than worth putting some effort into early so you can make sure everything’s looked after.

Establish an Emergency Fund

Make sure you have an emergency fund set up in a secure, easily-accessible location, such as a high-return savings investment account, of three and six months of your annual living costs before you even begin saving for retirement.

Having an emergency fund can save you from having to depend on credit cards or something like the fastest e transfer payday loans Canada 24/7 no documents which have high-interest rates and rapidly deplete whatever savings you may have.

Spend Less and Repay Your Debt

At least 10% of your income should be set away for savings, with another 5% set aside for unplanned expenses. You may discover more money for savings by cutting wasteful expenditures than you would expect.

Make the most of your home and auto insurance savings by implementing these sustainable living suggestions.

Before retiring, paying off debt reduces the strain on your lower income and gives you more freedom to pursue your interests.

Start paying off your loans, credit cards, and mortgages as soon as possible so that you won’t have any debt when you retire.

Budget

Living in poverty only to save money for retirement is pointless. Plan a realistic budget that would allow you to live comfortably until retirement, and then think about what a sensible budget might look like when you are no longer working.

Consider that you won’t have to pay for transportation, work attire, or other expenses when you retire.

You should spend more time on hobbies, travel, and leisure activities simultaneously.

Choose Your Target Retirement Age

You should choose your ideal retirement age after setting your retirement objectives, estimating your existing and projected funds, and evaluating your capacity for taking financial risks.

You should decide on a retirement age at which you have amassed sufficient assets to support your planned lifestyle.

Most individuals in Canada retire between the ages of 60 and 70. You may begin receiving Canada Pension Plan payments at age 60. (CPP).

However, most financial consultants advise delaying CPP payments until age 65 since the longer you wait, the larger your CPP payouts will be.

In general, waiting until age 65 to retire will result in 36% larger CPP payouts than retiring at age 60.

Increase Investments to Reduce Taxes

RRSPs, RESPs, and TFSAs are a few examples of the several tax-sheltered accounts available to all Canadians and may be used to postpone or lower taxes.

Use as much of your annual contribution capacity to benefit from these accounts.

Retirement Account and Plan Types in Canada

You may get a head start on saving for your senior years with the aid of various retirement accounts and programs while also receiving tax benefits.

Since no one plan is intended to replace your income, you may decide to dabble in them all, depending on your circumstances. These are the top three retirement plans to think about.

Registered Retirement Savings Plan (RRSP)

A tax-sheltered savings account that holds certain assets is known as an RRSP. You may start an RRSP as long as you’re working and under 69 years old.

With an RRSP, the government sets a contribution limit for you each year. You should contribute the maximum amount to your RRSP each year since doing so lowers your taxed income.

One benefit is that all donations to an RRSP grow tax-free. Therefore, you will only have to pay taxes on your profits if the assets within your RRSP perform well.

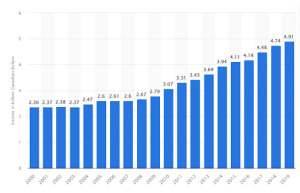

The total income that Canadian taxpayers and their dependents earned through Registered Retirement Savings Plans (RRSPs) from 2000 to 2019 are shown in this statistic.

The Registered Retirement Savings Plan provided about 4.91 billion Canadian dollars to Canadian taxpayers in 2019.

Total income through registered retirement savings plan (RRSP) in Canada from 2000 to 2019

Tax-Free Savings Account (TFSA)

Like an RRSP, a tax-free savings account often enables you to grow your savings tax-free.

You must confirm how much contribution space you have each year since there is a cap on the maximum amount that may be donated.

The money in a TFSA, in contrast to an RRSP, may be withdrawn tax-free at any time if you need it.

Canada Pension Plan (CPP)

The CPP is a government-run pension program created to help not just pensioners but also those with disabilities and the loved ones of people who pass away after contributing to the CPP system.

Your ability to get CPP benefits will be solely based on how much you have paid in payroll taxes over the years.

How Much Money Do I Require to Retire in Canada?

It is simpler to determine precisely how much money you need to set aside each month for retirement if you clearly understand your saving schedule.

Estimating your retirement income and then working backward using a fair rate of return are the two steps needed to determine your monthly savings rate. Starting with 10% of your net income is an excellent idea.

Conclusion

Retirement planning is a complex process, and many Canadians are discouraged from even beginning because of this.

However, the most crucial thing is to start immediately rather than worrying about the ideal location to save money and the perfect quantity to contribute.

You may change the procedure along the way, but the most crucial step is creating the positive habit of saving for the future.